From $10M to $350M: Simplifying the Insurance Buying Experience

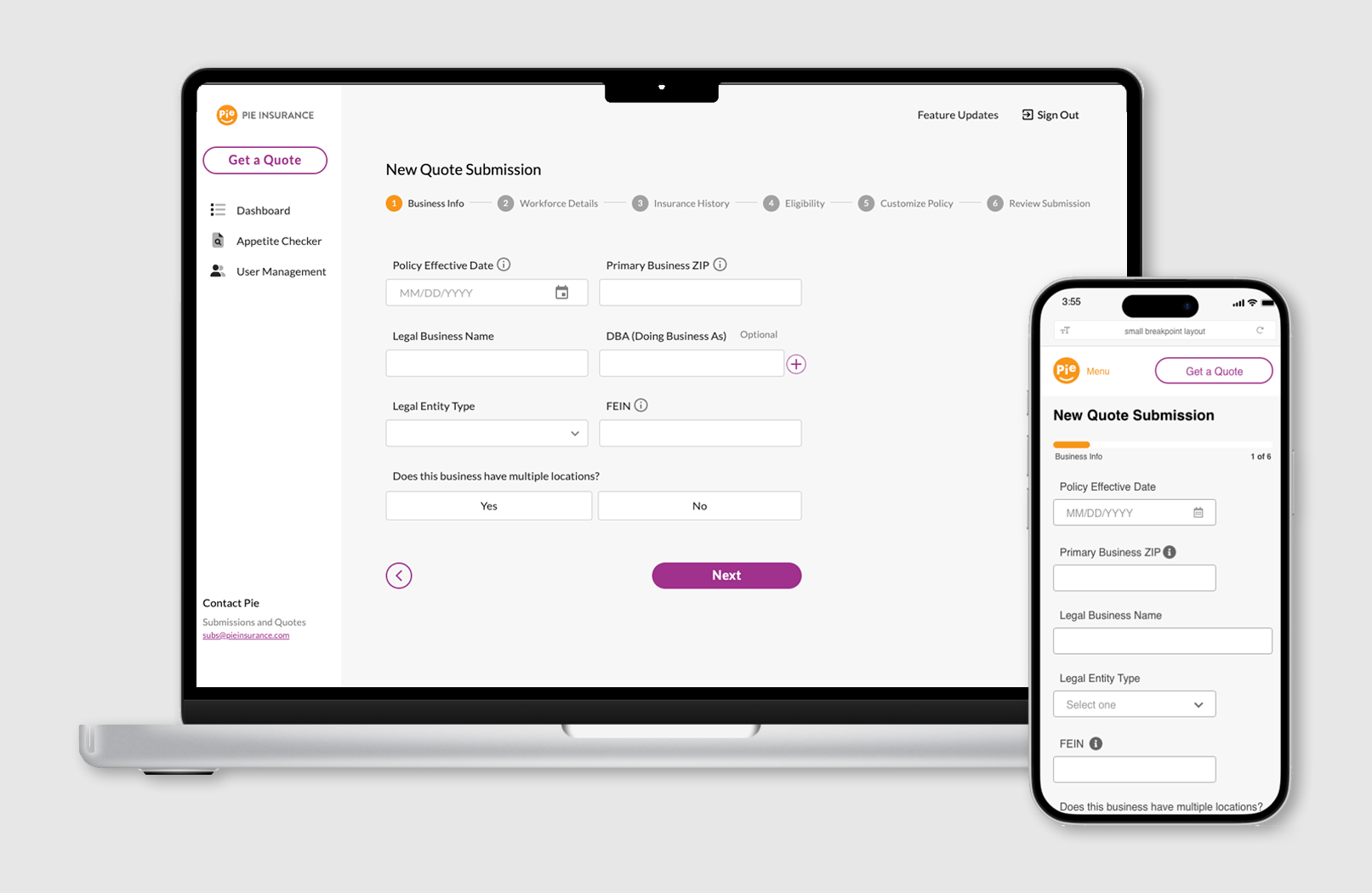

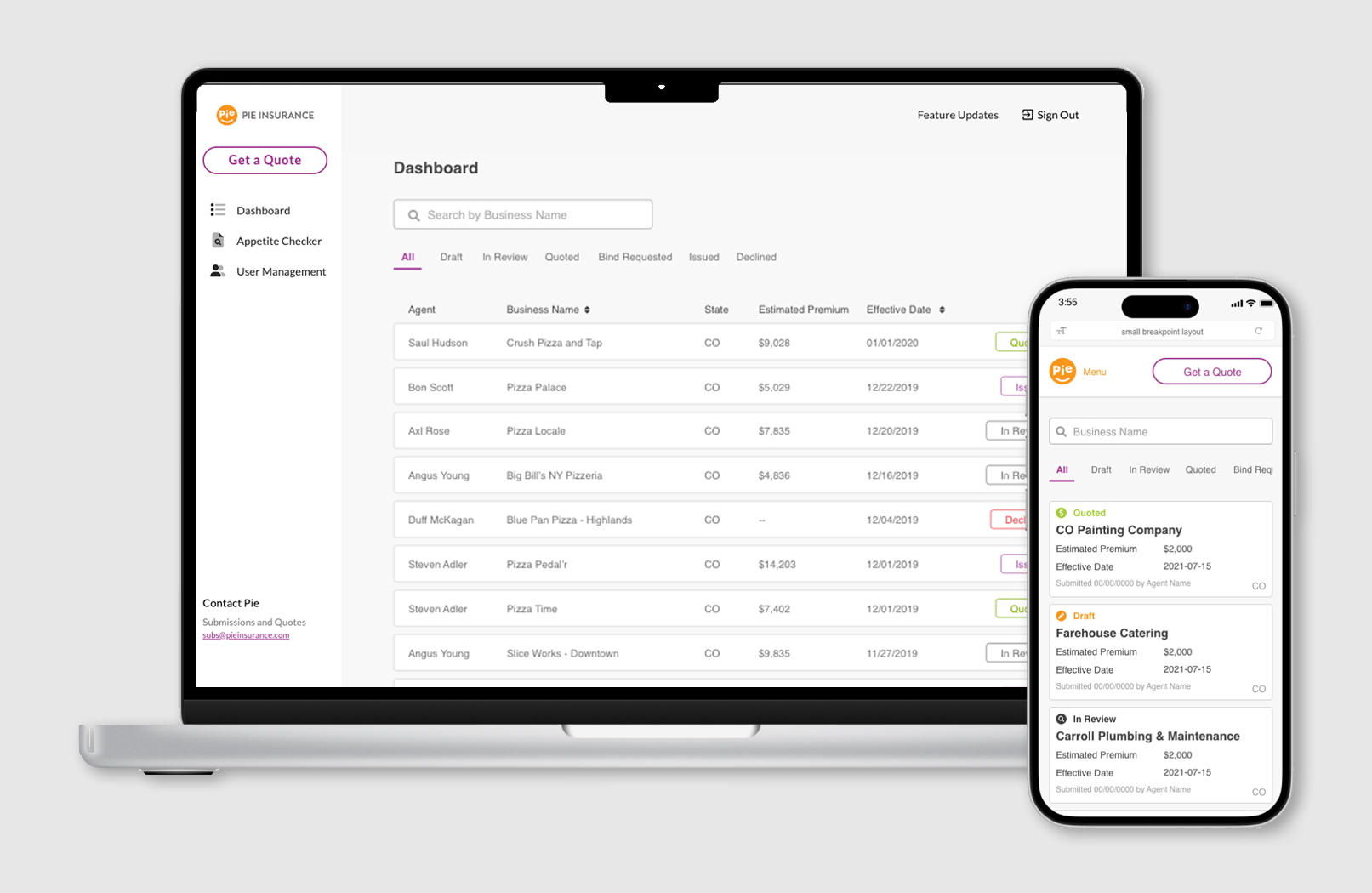

As Pie’s first Senior UX Designer, I led the end-to-end design of their Partner Portal, a 0 to 1 self-service quoting platform that helped scale the business from $10 million to $350 million in written premium. Through a user-centered approach and progressive disclosure design strategy, the portal became a key driver of Pie’s rapid growth.

Problem

Pie Insurance was rapidly onboarding agents to sell workers’ compensation policies, but the quoting process was a glorified Google Form with unique URLs for each agency and limited automation.

Submissions vanished into inboxes, leaving agents unable to track progress, make updates, or see outcomes. Far from “Easy as Pie,” it was a logistical nightmare in need of a scalable solution.

Role

Lead UX Designer

I was responsible for end-to-end research and design, from discovery to delivery.

Research & Discovery

Research included interviews with Pie underwriters, sales reps, business development managers, and agency partners to understand the ideal submission and rating process.

Usability testing on early prototypes provided workflow feedback that helped shape a more streamlined, agent-friendly experience — and led to three key learnings:

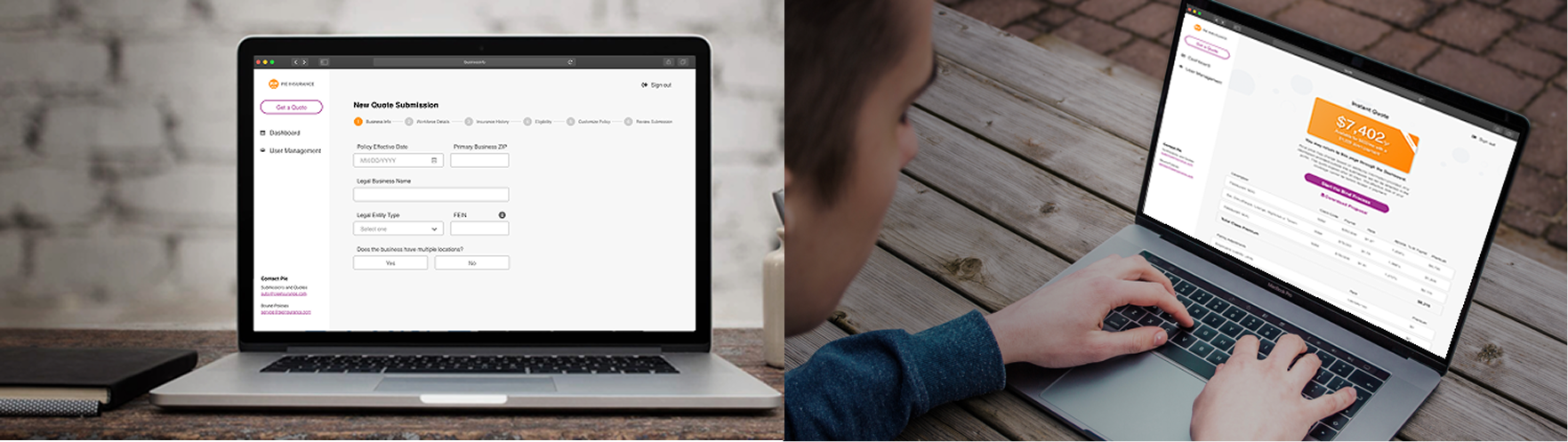

Speed is everything

Agents obtained quotes from 3–5 carriers for every business. An efficient question set and automated decisions were critical to being the first choice rather than an afterthought.

The ACORD 130 is the gold standard

As part of their process, agents collected ACORD 130 forms from clients. Any carrier-specific questions not listed on that form slowed down the submission process and created friction.

Self-service is the best service

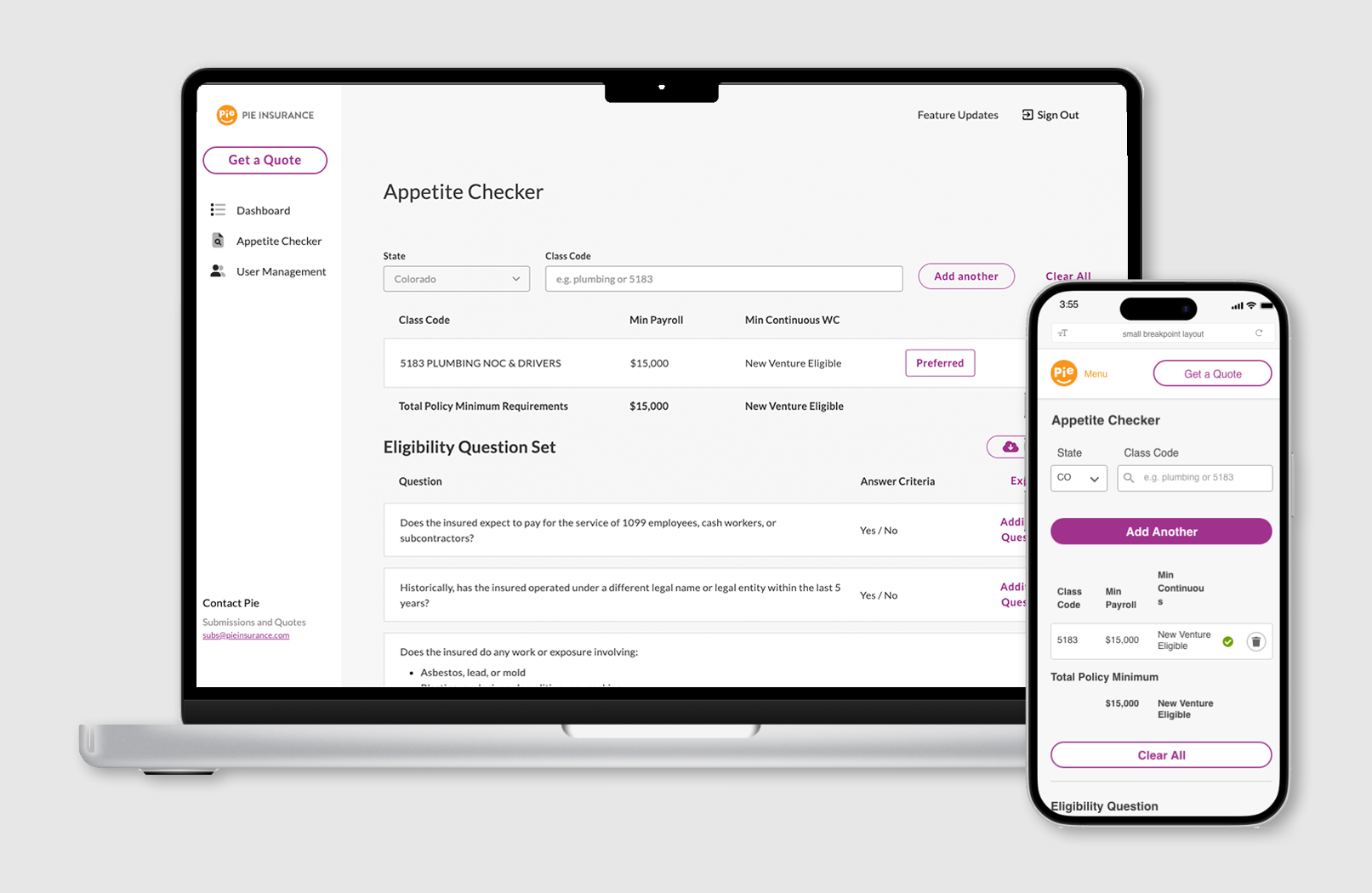

Agents preferred carrier portals that let them update submissions, service policies, and access documents without needing to contact the carrier.

Design Strategy

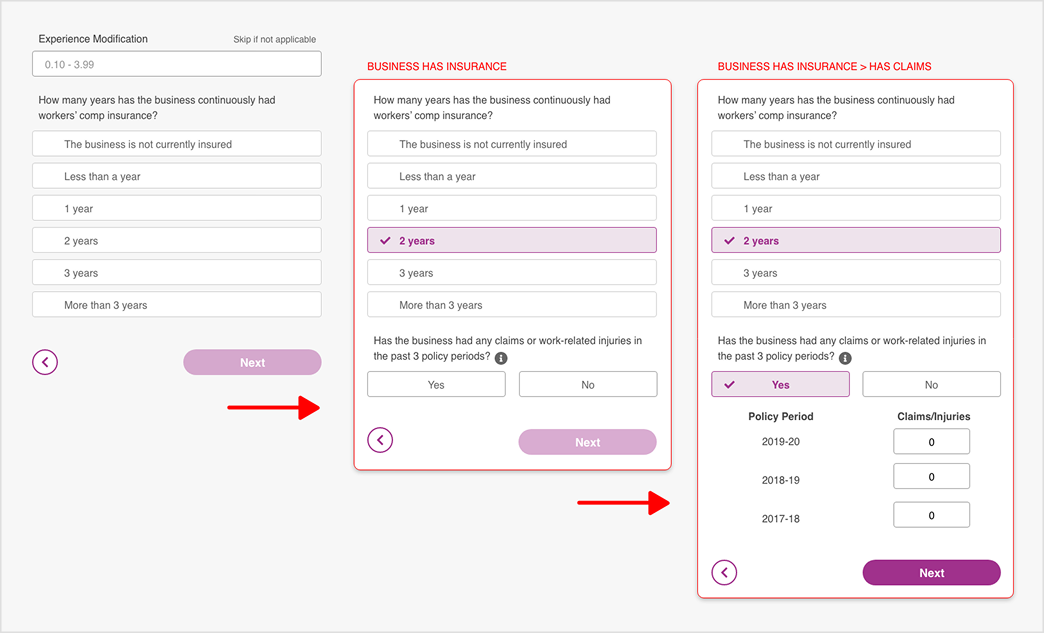

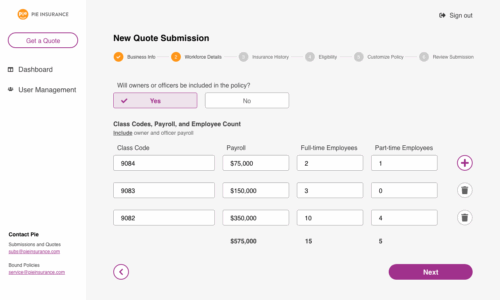

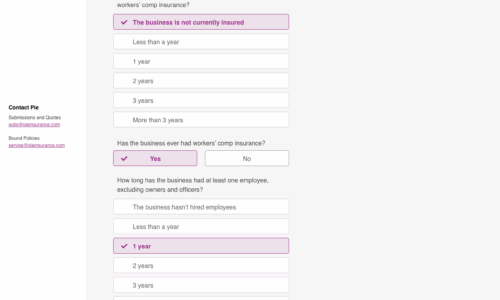

The design strategy utilized progressive disclosure to simplify the interface, reduce cognitive load, and get agents to a decision as quickly as possible.

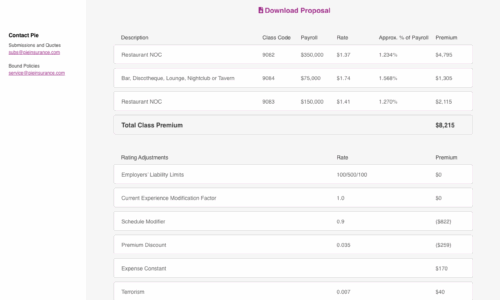

Results & Final Design

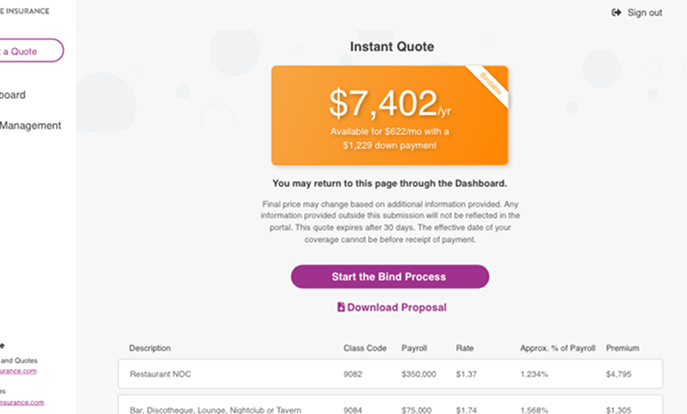

Launched in April 2020, Pie’s Partner Portal introduced online quoting, instant decisioning, submission tracking, and appetite checks — cutting quoting time to under five minutes and earning an Insurer Innovation Award in 2022.

Between launch and September 2024, the portal helped Pie grow from MGA to a licensed Insurance producer.

35x

Growth in total written premium from $10M to $350M

2900%

Increase in submission volume, reaching over 30k submissions per month

10x

Growth in Pie’s appointed agency base from 400 to 4000+